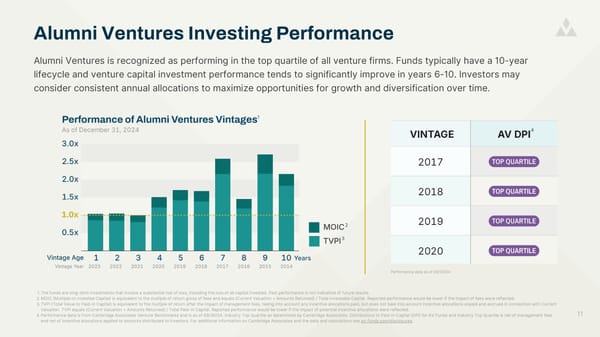

Alumni Ventures is recognized as performing in the top quartile of all venture firms. Funds typically have a 10-year lifecycle and venture capital investment performance tends to significantly improve in years 6-10. Investors may consider consistent annual allocations to maximize opportunities for growth and diversification over time. 4 The funds are long-term investments that involve a substantial risk of loss, including the loss of all capital invested. Past performance is not indicative of future results. 1. MOIC (Multiple on Invested Capital) is equivalent to the multiple of return gross of fees and equals (Current Valuation + Amounts Returned) / Total Investable Capital. Reported performance would be lower if the impact of fees were reflected. 2. TVPI (Total Value to Paid-In Capital) is equivalent to the multiple of return after the impact of management fees, taking into account any incentive allocations paid, but does not take into account incentive allocations unpaid and accrued in connection with Current Valuation. TVPI equals (Current Valuation + Amounts Returned) / Total Paid-In Capital. Reported performance would be lower if the impact of potential incentive allocations were reflected. 3. Performance data is from Cambridge Associates Venture Benchmarks and is as of 09/30/24. Industry Top Quartile as determined by Cambridge Associates. Distributions to Paid-In Capital (DPI) for AV Funds and Industry Top Quartile is net of management fees and net of incentive allocations applied to amounts distributed to investors. For additional information on Cambridge Associates and the data and calculations see av-funds.com/disclosures. 4. Performance data as of 09/30/24 11 2 3 1 Alumni Ventures Investing Performance

Spike Ventures Overview Page 10 Page 12

Spike Ventures Overview Page 10 Page 12